- The absence of a formal consumer credit rating system in the UAE resulted in consumers having easy access to loans without any check on the repayment capacity. However, the launch of the Al Etihad Credit Bureau is expected to change the scenario by providing banks access to consumers’ credit history, thereby curbing excess lending and raising the quality of retail lending in the country.

Al Etihad Credit Bureau (AECB) will start providing consumer credit reports to financial institutions from September 2014, and this is expected to have widespread implications for consumers, banks, and the UAE’s economy. However, in order to assess the impact that the Al Etihad Credit Bureau (AECB) is expected to have, it’s important to understand the history of credit check activities in the UAE.

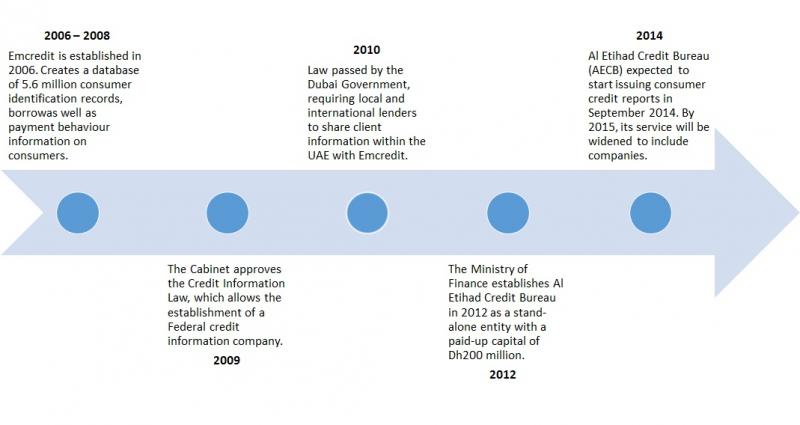

The first step in the credit check history of the UAE was the creation of the Emirates Credit Information Company (Emcredit) in January 2006. Emcredit, the first private credit company in the UAE, was expected to be compliant with international standards of data protection and security. It provided industry information to a federal technical advisory committee working for creating a regulatory framework to share credit information across UAE. Between 2006 and 2008, Emcredit established a database of 5.6 million consumer identification records, and also gathered payment behaviour information on consumer and commercial borrowers, and held 35 per cent of mortgage data in the UAE.

However, the global financial crisis in 2008 impacted the UAE as well, most notably the real estate sector in the country. As the real estate bubble burst, the regional economic boom in UAE came to an end, and banks suffered the most with large scale debt default. This forced the banks to revisit their existing portfolio and take a strategic decision on their future lending activities.

Among other things, it made the government and lenders (banks and other lending institutions) realize the importance and urgency of strengthening the process of gathering and sharing credit information on consumers. In March 2009, the Credit Information Law was approved by the Cabinet, allowing the establishment of a Federal credit information company that would provide comprehensive services and solutions related to credit information. In July 2010, a law was passed making it mandatory for all the lending institutions, utilities and telecoms companies, to share client information within the UAE with Emcredit.

Timeline of Credit Check Activities in the UAE

Source: TheNational, Arab Business Review Research

With increasing need for a centralized consumer credit information system, bylaws were prepared for establishment of a federal bureau and Al Etihad Credit Bureau (AECB) was established in 2012. The ministry of finance established the AECB with a paid-up capital of Dh200 million. It started compilation work in 2013 and is expected to start providing consumer credit reports to financial institutions from September 2014. In addition, the bureau is also expected to come up with regulations to curb excess lending and rising consumer debt.

AECB is aiming to achieve its goals in a multi-phase process. The first phase will be launched in September 2014 allowing the banks and financial institutions to access existing and potential customers’ credit reports electronically. This information can be purchased as credit reports on submission of required documents. The lending institution will, however, need a written consent from the borrower to obtain the report. The customers can also access their credit reports by paying a fee through customer service centres. The report will include name, current address, and employment, credit repayment history for last 24 months, credit and loan histories, and overdues and default records for past 24 months.

To start with, the reports will be based on UAE data only, however, in future there is a plan to work closely with international credit bureaus like Experian, Equifax, CIBIL, SIMAH etc. to provide a more complete report. As of now, the credit report issued by the bureau will have no relevance overseas as the bureau will not get access to credit history of the banking consumers outside UAE. By 2015, the AECB is expected to provide credit coverage on companies as well.

The retail lending environment in the UAE is expected to undergo a radical change, as the bureau becomes operational and start issuing credit reports.

For banks, the credit reports from bureau will provide much needed inputs in the lending process and therefore improve the quality of credit. The reports will highlight unclosed bank accounts, non-cancelled or unused credit cards, outstanding payment and loans on several credit cards and overdraft facilities. Therefore, it will enable the banks in decision making and reject requests for loans and credit cards to individuals having a poor repayment history even if they have the capacity to pay. It will also help the banks to charge high or low interest rates depending on the risks associated with each consumer. As banks will have more clarity on consumer’s payment history and current loans status, they can ensure that they do not over-lend, and therefore have a relatively high-quality loan portfolio.

It is also likely to lead to a growth in the personal loans for debt settlement with consumers consolidating their debt positions. As a result, products such as Abu Dhabi Islamic Bank’s Al Khair Liabilities Settlement are set to benefit from the AECB’s consumer data reports.

For consumers, these reports will act as bitter pills as they will stop individuals from applying for multiple loans beyond their repayment capacity, and ensure that they do not fall into a debt trap. Individuals with better credit profiles will be rewarded as banks will be keen to lend to individuals with a good credit profile. Further, with the UAE Central Bank setting limits on the share of government-related enterprises (GRE) lending in banks’ loan portfolio, banks will seek to increase their lending to private companies, SMEs and individuals – once again, companies and individual with a strong credit history will stand to benefit.

The short-term impact will include slower credit growth, which could have its spill-over impact on the overall economy; however, in the long-run, the bureau will help improve the credit environment for consumers and lenders, alike.

As the UAE transitions from its current lending environment to a new one, credit growth is likely to be impacted as over-indebted customers may not be able to get new loans. This will impact banks like Abu Dhabi Islamic Bank and Dubai Islamic Bank that have retail loans as a major contributor to their loan book. For consumers, access to credit will no longer be as easy it was in the past, and growth in credit for existing borrowers will be much slower. A tightened lending regime will likely reduce liquidity and thus spending, and might pose a short-term challenge to UAE’s economy, that has recently shown signs of recovering from the 2008 financial crisis.

However, on the positive side, growth in new customers without any credit history will be rapid. Also, credit reports will make UAE nationals more aware of financial management and ensure that they maintain a good repayment profile to improve their future credit prospects. In the long-run, the system is expected to lower the default rates, improve customer pricings and improve the risk charged on personal loans.

In a nut-shell, if executed well, the AECB’s roll-out will put an end to free-for-all lending and support the economy via a more sustainable credit cycle.

The article was originally published at: Arab Business Review

To read more thought-leadership stuff by leaders from Arab Region, please visit Arab Business Review